A discomforting question, right? Nonetheless, most questions are. Let’s take the heat away for a moment and see this situation from a potential investor’s point of view.

Scenario number one: Three hypothetical co-founders have an equity share of 55%, 30% and 15% respectively. You are the one with majority shares i.e. 55%. An investor might look at it as if you do not value your co-founders yourself, lack trust in them or are they really not good enough. After all, investors invest in people and not just ideas and that is all you have when you begin. If that is a calculated decision and you can justify it then that’s good otherwise you might find yourself in trouble.

Scenario number two: Two hypothetical founders split it simply as 50-50 for each. Now, suppose, a potential seed investor may see it as the red flag, seeding doubt in her/his mind regarding you having poor negotiation skills. If you can again justify enough that how you come to that calculation, you shall be fine.

Now, when you know that splitting the equity wisely can have an impact on your startup’s growth, let’s dive deep and understand how to actually do it.

We will learn to do the following two things to get to the answer.

Step 1: Follow a formula. Yes, a formula!

Step 2: Setting up a vesting scheme for your startup

Step one shall help you find out what shall the per cent share be. The second step will help you find out answers to the questions like; Will at the very beginning each founder gets his or her full package of stocks or will there be a cliff to climb before reaching that number. It would help you legalise things, ultimately saving you from potential disputes later.

Founders’ Pie By Frank Demmler

Notice the elements in the table below.

Your next job is to establish the relative importance of the elements by weighing each on a scale of 0 to 10. A tech startup ‘idea’ is fair to be weighed 7 or 8 whereas an idea of a restaurant may be weighed only 2 or 3. Similarly, a business plan may weigh less if the founders themselves are putting in the money by themselves. Same goes for other matrices too.

In the table below, you got to fill the columns as per the individual founder’s contribution to that field. One who brought the idea to the table can be given 9. One with great industry connections can be assigned a better on the scale than other for this matrix.

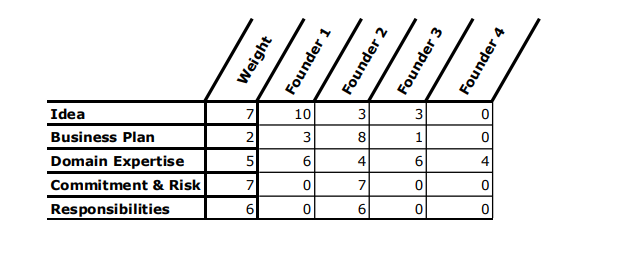

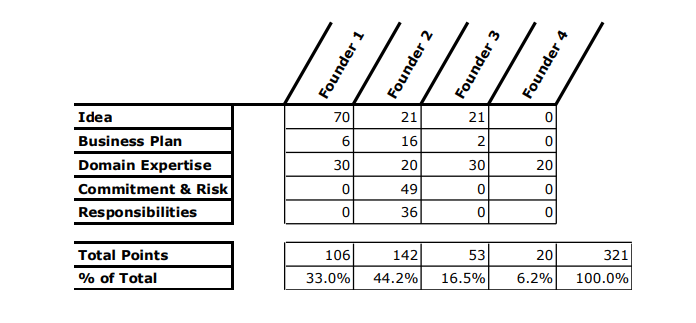

Let’s take a hypothetical scenario and see how things turn out. Read the tables below and analyse.

Relative importance of the elements

Relative contributions of the founders

Now, when you have a fair idea of the equity split, let’s learn about the second step which is vesting scheme.

Setting up a vesting scheme

If you are unsure about the risk-taking capabilities of your co-founders and fear that they might leave the relay in between, leaving you helpless, then you are not wrong to think like that. Setting up a vesting schedule is very important. You can not just your co-founder walk away with 20% of company share if he/she chooses to quit too soon.

Here is how a vesting schedule for a cofounder number 2 from the above table may look like.

He/she has 44.2% of the company on paper, right? Unfortunately, that founder decides to leave the company or get fired within a year then as per your designed vesting terms he/she walk away with nothing. After the one year point, you get 25% of your stock and every month after that he/she gets an additional 1/48th of their total stock. This way they only earn all of their stock at the end of four years. Clean and clear, right?

Through the vesting scheme, you decide you can also understand what happens if an advisor, a board member or a co-founder is added later to the team.

Conclusion:

There are a hell lot of questions regarding equity splitting founders worry about and there not wrong to do so. It is good to worry, which mean you care for your startup. Keeping all questions aside, try this strategy and let me know if you agree with this approach or not.

Main Image: ©Columbia Pictures

Be First to Comment